You must activate the terms and conditions.

Subscribe now and we'll keep you informed about tax news, income tax returns, stimulus checks and more

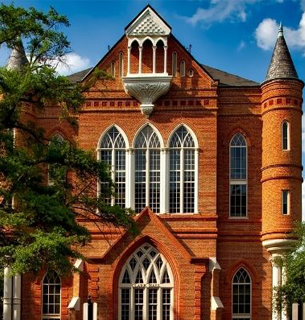

IRS Building Near Me

Disclaimer: Please note that this website is not affiliated with the official IRS portal and/or any related government agencies. On this platform, you can find information about your closest IRS local office to carry out your tax procedures. If you wish to visit the official IRS website, please click on this link.

To find your closest IRS office, please select your location to see the list of all available branches. However, please make sure to call ahead before making your visit either via email or by using the provided IRS phone number.

Our website is for informational purposes only. We advise checking and confirming the exact details of the office that you want to visit beforehand.

Please bear in mind that all IRS offices and TAC locations only operate by appointment. After finding the location of your closest branch, make an appointment via phone call.

Find your nearest local IRS office

You must activate the terms and conditions.

Subscribe now and we'll keep you informed about tax news, income tax returns, stimulus checks and more

What Our Website Will Help You With

The purpose of this website is to provide taxpayers with the necessary information about their closest IRS offices. The processes at walk-in offices can be time-taking. And they can become even more of a hassle if you are not aware of close-by TAC locations, and instead have to drive to distant ones.

Using our website, you can find contact and location information about your closest IRS local office.

What Our Website Won’t Help You With

Apart from listing active IRS offices, this website does not perform any other tax-related services. If you want to learn more about your taxes, please get in touch with a tax accountant or visit your IRS local office.

For other miscellaneous tax details (such as outstanding balance, tax records, etc.), you can visit the official IRS website and log in to your account. Our website does not offer this information.

Filing Tax Return

You cannot use this website for filing your tax return nor do we provide any assistance for this process in an advisory capacity. To file your tax return, you can visit the official IRS portal, or acquire the help of any legal entity (lawyer, accountant, etc.)

Making Payments and Filing Refund Requests

You cannot make tax payments, or file a refund request via our website. To make your tax payment, or to make a refund request, you can visit the official IRS website.

This website also does not provide any details or updates on ongoing refund processes.

How to Make IRS Tax Payments?

Please note that our website does not provide IRS payment services. However, for the edification of taxpayers, here are the various methods that can be used for this process:

- Credit and Debit Cards - You can use your bank debit or credit card to make your tax payment. You can make the payment via phone, or by using the mobile app.

- Installments - The Installment Agreement is not available for all taxpayers. You have to first apply for it via the IRS website.

- Electronic Funds Withdrawal - After electronically filing your tax return, you make the payment via your bank account.

- Direct Pay - You can also pay directly from your checking/saving bank account without incurring additional costs.

- Cash Payments - You can pay your taxes in cash at several different participating locations all around the US. You can find more details about this process on this page.

Scams and Frauds

If you wish to report (or learn more about) tax scams and frauds, you can visit the official IRS website. Our website does not support this service.

There are different methods that scammers can use for their fraudulent exploits. You can learn about them in detail by clicking on this link.

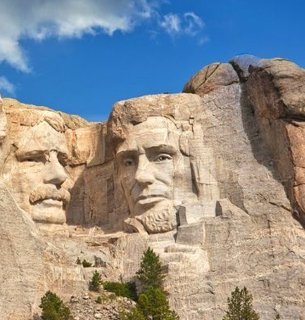

If the Internet is not for you or you do not trust this method and prefer to go in person to one of the IRS offices, you need to know what paperwork is available at the IRS offices. The individual documents are explained below.

It is worth mentioning that these procedures available at IRS offices in the United States can also be carried out through the official IRS website, from your account. If you don't have one, you can create one at this link.

FACT: The information below depends on the state you are in, as not all have the same rules.

Check the status of your refund

You can check the status of your refund, process the refund, and request approval to issue the refund. If the procedure was done digitally, it may take up to 24 hours for the refund to be sent. If the refund was done by mail, on paper, it may take up to 4 weeks.

Set up a payment plan

Among the procedures available at the IRS offices is the application for payment plans. This should be done in case you believe you will not be able to pay your taxes before the due date. It can be a long term or short term payment plan.

Make a payment

- Make an external payment from your bank account.

- Pay with your credit card, debit card or digital wallet.

- Make or schedule payments through the Electronic Federal Tax Payment System (EFTPS).

- Instant wire transfers.

- Money order or checks sent by the post office.

- Payments in cash.

- Cash withdrawals.

Get a transcript of your tax return

You can request copies of your tax documents, such as tax account information, income and salary statements, transcripts of prior years' tax returns, and even a letter confirming that no tax return has been filed.

Individual Tax Identification Number (ITIN)

Another of the procedures available in the IRS offices is to request the Personal Taxpayer Identification Number (ITIN) to file tax returns in excess of the amount agreed for the year.

Filing of tax returns.

While it is no longer common to file a tax return at an IRS office, it is possible to file online, using various digital forms.

- Use "Free File" or the official IRS website to download the required form and then print it.

- Access a free site to prepare your tax return.

- Use commercial software.

- You can find an authorized e-File provider.

Assistance to victims of identity theft

Identity theft is one of the most common scams in the United States, so you can seek help from the Taxpayer Protection Program that the IRS provides to its beneficiaries.

This program identifies a suspicious tax return in the name and social security number of the owner. Upon detecting any signs of fraud, the IRS will send a letter or notice directly.

Among the procedures available at the IRS offices, you have the option of requesting this help because someone else may be using your identity to commit crimes, such as opening a new bank account with your SSN, among many other things.

Access your account information

One of the procedures that can be carried out at the IRS offices is to access your account information, although this can be done directly from the web, to save you the trip to one of the IRS branches. You will be able to access the following information:

- Verify and make payments.

- Check your balance.

- Check your tax records.

- Learn about licensing tax professionals.

- Create payment plans.

- Manage your communication preferences with the IRS.

Find out where you can file your tax return.

If you need to know where to file your tax return, we recommend filing online, as paper filing can take up to a month to complete.

If you are a taxpayer or tax professional, performing this due diligence online is preferable as it is easier and faster. You can do it from Free File, the IRS service, through an electronic file, or from its website, filling out the forms you need.

Get volunteers to help you with your tax preparation.

You can ask for help from volunteers who belong to the Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) centers, which provide assistance in various tax operations, such as filing taxes. People who can apply for this type of assistance include:

- People with disabilities.

- Individuals with an income or $58,000 or less.

- People with a low level of English.

- People over 60 years.

More information

If you want to know more about the procedures you can carry out and the benefits granted by the IRS, as well as all the forms, you can enter our site and clarify all your doubts.

Additionally, you will find all the information you need about each of the offices within each state of the country, from their opening hours, telephone numbers to their addresses.